Get This Report about Personal Loans Canada

Table of ContentsA Biased View of Personal Loans CanadaSome Ideas on Personal Loans Canada You Should KnowThe Greatest Guide To Personal Loans CanadaNot known Details About Personal Loans Canada Getting The Personal Loans Canada To Work

Let's study what a personal financing actually is (and what it's not), the factors people utilize them, and how you can cover those insane emergency expenditures without handling the problem of financial obligation. A personal financing is a swelling amount of money you can obtain for. well, almost anything.That does not include obtaining $1,000 from your Uncle John to assist you pay for Christmas presents or letting your roomie spot you for a pair months' rental fee. You shouldn't do either of those points (for a number of reasons), yet that's technically not an individual loan. Individual lendings are made via a real monetary institutionlike a bank, lending institution or on-line lender.

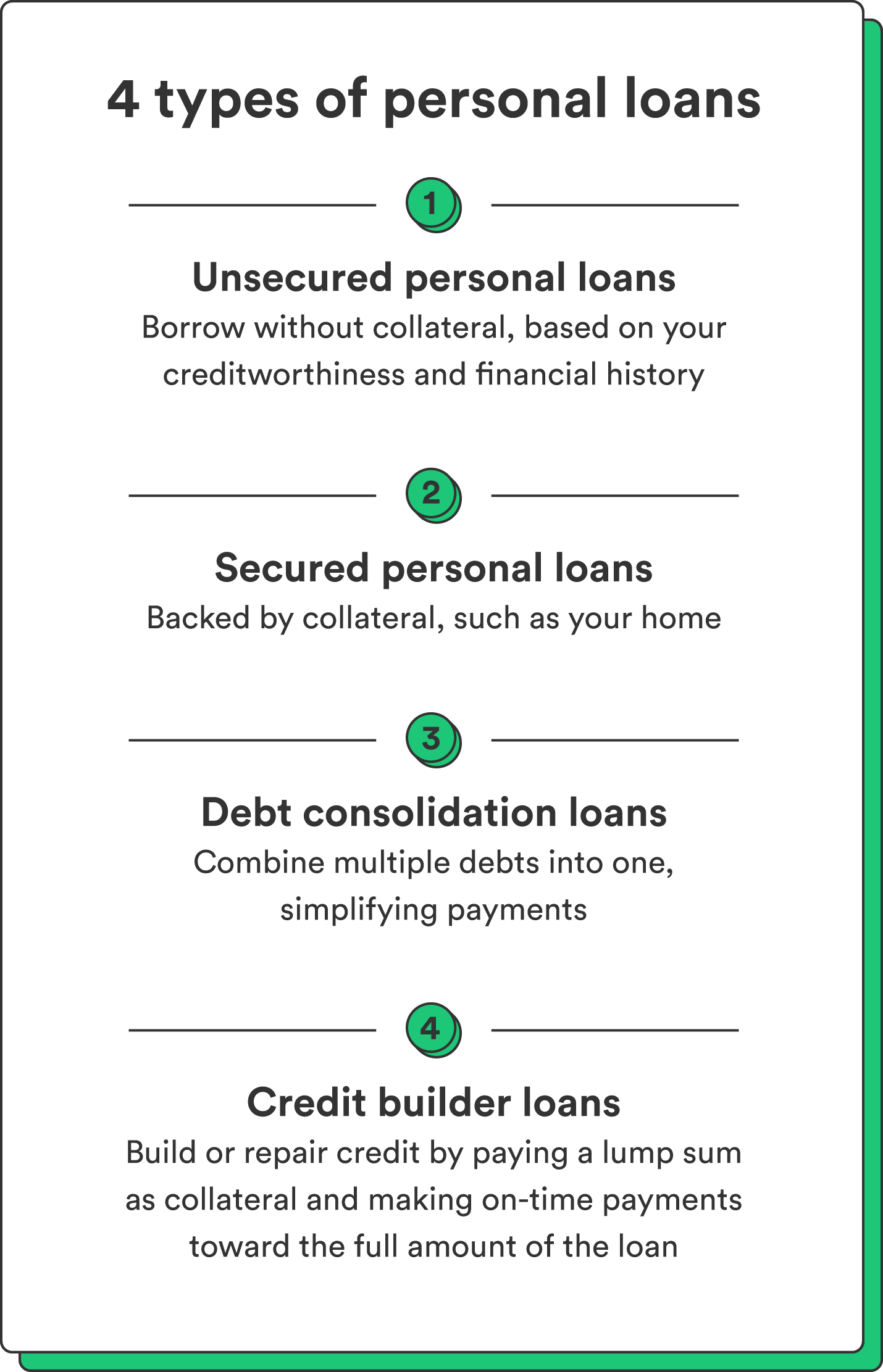

Let's take a look at each so you can recognize exactly just how they workand why you don't need one. Ever.

7 Easy Facts About Personal Loans Canada Explained

Surprised? That's okay. Regardless of exactly how great your debt is, you'll still need to pay rate of interest on most individual finances. There's constantly a price to pay for borrowing money. Protected individual lendings, on the various other hand, have some type of collateral to "secure" the finance, like a boat, jewelry or RVjust among others.

You might additionally get a safeguarded individual funding utilizing your auto as collateral. But that's a hazardous step! You don't desire your major setting of transport to and from job getting repo'ed due to the fact that you're still paying for in 2015's cooking area remodel. Trust fund us, there's nothing protected about guaranteed loans.

Just because the repayments are predictable, it does not imply this is an excellent bargain. Personal Loans Canada. Like we stated in the past, you're virtually assured to pay interest on an individual loan. Simply do the math: You'll wind up paying method more in the future by getting a lending than if you would certainly simply paid with cash money

:max_bytes(150000):strip_icc()/how-apply-personal-loan.asp-final-e0c4e2e22f254e54a6cdf927b0a4f8ab.jpg)

Indicators on Personal Loans Canada You Need To Know

And you're the fish hanging on a line. An installation funding is an individual finance you repay in dealt with installations in time (normally when a month) up until it's paid completely - Personal Loans Canada. And do not miss this: You need to repay the original loan amount prior to you can obtain anything else

However don't be mistaken: This isn't the like a credit score card. With line of credits, you're paying rate of interest on the loaneven if you pay in a timely manner. This type of finance is extremely challenging because it makes you believe you're handling your debt, when actually, it's managing you. Payday advance loan.

This set gets us irritated up. Why? Because these organizations exploit people that reference can't pay their costs. And that's just incorrect. Technically, these are short-term car loans that provide you your income beforehand. That may seem confident when you remain in a financial try this website wreckage and need some cash to cover your bills.

More About Personal Loans Canada

Why? Due to the fact that points obtain actual messy genuine quick when you miss a repayment. Those lenders will follow your wonderful grandmother who guaranteed the loan for you. Oh, and you must never guarantee a car loan for anybody else either! Not only could you get stuck with a funding that was never ever meant to be yours to begin with, however it'll spoil the relationship prior to you can say "pay up." Trust fund us, you do not wish to be on either side of this sticky situation.

All you're truly doing is making use of new financial obligation to pay off old financial obligation (and expanding your finance term). Business recognize that toowhich is specifically why so several of them use you consolidation fundings.

And it begins with not obtaining any type of even more money. ever before. This is a great regulation of thumb for any monetary acquisition. Whether you're considering obtaining an individual car loan to cover that kitchen remodel or your frustrating bank card costs. do not. Taking out financial obligation to spend for things isn't the method to go.

How Personal Loans Canada can Save You Time, Stress, and Money.

And if you're taking into consideration a personal financing to cover an emergency situation, we get it. Borrowing cash to pay for an emergency situation just intensifies the stress and difficulty of the scenario.